Warehouse Demand Spikes Amid Growing E-commerce and Increased Safety Stock

Growth in e-commerce and changes to companies' inventory policies have increased demand for warehouse space, and the existing network is filling up. E-commerce is expected to increase during the holidays as customers social distance and shop from home. The Wall Street Journal has reported that retailers are working to find more space and locking in additional fulfillment capacity for holiday items, such as toys, and essential goods, such as paper towels.

"Many supply chains were designed to hold minimum inventory in pursuit of a just-in-time model. The COVID-19 crisis exposed the weakness in this strategy when a production source shuts down. Going forward, companies will increase reserves of inventory," said Michael Zimmerman, a partner with the global strategic management consulting firm A.T. Kearney and lead author of the 31st Annual State of Logistics Report. The report was introduced by the Council of Supply Chain Management Professionals (CSCMP) and presented virtually by Penske Logistics.

Zimmerman said that CBRE Research forecasts indicate that a 5 percent increase in business inventories would require an additional 700 million to 1 billion of occupied square feet. He added that those in the supply chain won't forget the pain of lost sales and disruptions. "Manufacturers will hold safety stock, and retailers and CPGs will hold more inventory of goods," he said.

Penske offers several warehousing solutions, including multi-client warehouses that give customers the benefit of Penske's expertise with the flexibility to manage seasonal surges and temporary warehousing needs.

What's more, companies are looking at the strategic placement of distribution centers to ensure they can get goods to consumers and retailers quickly while still utilizing ground transportation. Penske has invested in sophisticated technology that can use supply chain data to create models to run 'what-if' scenarios using different warehouses and distribution center locations to find the optimal network.

There are several ways to optimize warehouse operations inside the facility's walls, said Dave Bushee, vice president of information technology for Penske Logistics. The overall design of a location and slotting algorithms can all boost efficiency. Penske can evaluate warehouse design and provide solutions for streamlined operations. Additionally, warehouse engineers can review every procedure within a location, from receiving to inventory management to returnable container programs, to find efficiencies.

That can be especially useful during the holidays when new items are added, such as winter-specific food and beverages or new toys. "Around Halloween, Thanksgiving and Christmas, you're not only re-slotting the warehouse but also looking to slot that holiday product in a specific place to drive efficiency. That holiday/seasonal aspect is a huge play in how you want to re-layout your warehouse," Bushee said.

Penske Logistics designs streamlined warehouse layouts that are built for the most efficient access to goods and overall execution of labor within your warehouse. Team up with us to implement a data-driven warehouse design strategy that will maximize your performance inside and set you up for success outside your distribution centers.

Moses said the stakes are high for 3PLs on the technology front and the ability to make an impact with the right systems is significant. For example, data is key to driving costs out of networks, and network optimization and transportation management, which are all fueled by information, are key elements in managing expenses. Capturing, monitoring and utilizing data allows Penske to examine trade-offs in transportation and distribution costs and also make facility recommendations.

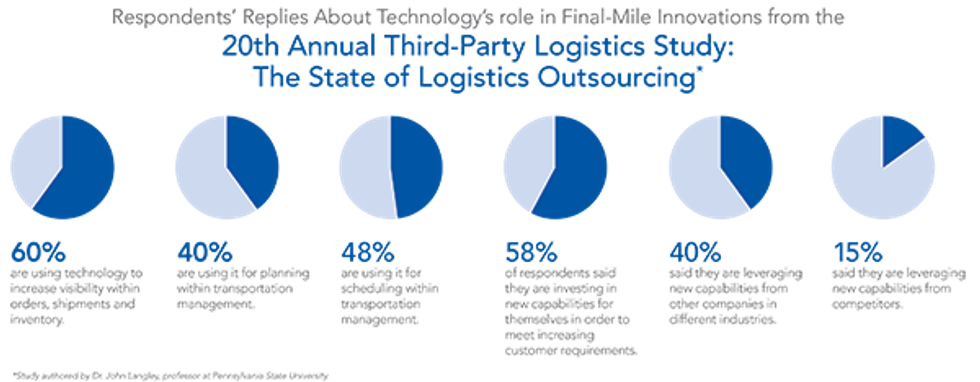

Moses said the stakes are high for 3PLs on the technology front and the ability to make an impact with the right systems is significant. For example, data is key to driving costs out of networks, and network optimization and transportation management, which are all fueled by information, are key elements in managing expenses. Capturing, monitoring and utilizing data allows Penske to examine trade-offs in transportation and distribution costs and also make facility recommendations. The final mile is an area of competition within the overall portfolio of logistics services, and shippers are demanding innovative solutions and timely deliveries. To ensure success within the final mile, providers are utilizing route optimization, incentivized scheduling, and real-time electronic tracking and communication, all of which are moving products from the manufacturer to the end user faster than ever.

The final mile is an area of competition within the overall portfolio of logistics services, and shippers are demanding innovative solutions and timely deliveries. To ensure success within the final mile, providers are utilizing route optimization, incentivized scheduling, and real-time electronic tracking and communication, all of which are moving products from the manufacturer to the end user faster than ever.

While 3PLs are experiencing new opportunities, they are also working through challenges. In North America, CEOs are focused on finding and keeping management talent, facing continuing margin pressures and coping with capacity shortages. “Capacity problems are huge in the U.S. but not as prevalent globally,” Lieb said.

While 3PLs are experiencing new opportunities, they are also working through challenges. In North America, CEOs are focused on finding and keeping management talent, facing continuing margin pressures and coping with capacity shortages. “Capacity problems are huge in the U.S. but not as prevalent globally,” Lieb said.